| ОГНОО | ГАРЧИГ | ТЕКСТ | ЗУРАГ |

|---|---|---|---|

| 2008.08 | TDB Capital LLC was established | ||

| 2010.12 | TDB Capital LLC began its operations | To expand investment banking operations, Mongolian leading financial service provider Trade & Development bank of Mongolia restructured their "External communications, and investment banking department" and transferred its Investment banking operations to its subsidiary TDB Capital LLC. |  |

| 2011.01 | Received professional licenses to operate in the Mongolian capital markets | TDB Capital began operating in the capital markets after being licensed by the Financial Regulatory Commission to provide investment services on behalf of the client and other (brokerage) services. |  |

| 2019.10 | Obtained a special license to provide dealer and investment advisory services in the capital market |  | |

| 2019.12 | Received a license to operate a nominal account and to broker foreign securities trading. |  | |

| 2021.11 | The company's given name has been changed. |  | |

| 2023.10 | Obtained a license to provide mining brokerage services. |  |

| ОГНОО | ГАРЧИГ | ТЕКСТ | ЗУРАГ |

|---|---|---|---|

| 2011.03 | Received licenses from the Financial Regulatory Commission for providing professional services in the capital market | Санхүүгийн зохицуулах хороонооос андеррайтер болон харилцагчийн нэрийн өмнөөс түүний даалгавраар гүйцэтгэх хөрөнгө оруулалтын бусад ажил үйлчилгээ (брокер) үзүүлэх тусгай зөвшөөрлийг авлаа. | |

| 2011.04 | Joined into the Mongolian Stock Exchange as a member, and became a professional capital market participant |  | |

| 2023.10 | Became a member broker of the Mining Products Exchange |  |

| ОГНОО | ГАРЧИГ | ТЕКСТ | ЗУРАГ |

|---|---|---|---|

| 2012.07 | Executed first ever T+3 securities settlement transaction | The first ever transaction following the T+3 securities settlement procedures of the Settlement bank at the Mongolian stock exchange was made through our company. |  |

| 2012.12 | Implemented first ever securities “Back Office” program in Mongolia | Due to an update at the Mongolian Stock Exchange trading system, securities settlement reporting, and booking system “Back Office” was developed in-house and was implemented in operations, a first in Mongolia |  |

| 2013.05 | Introduced first in-house online trading platform in Mongolia | In order to contribute to the infrastructure of the capital market, and to provide clients with a new, easy to use service based on technology, we introduced the first ever online trading system in Mongolia where our clients can make orders, and monitor accounts online. |  |

| 2015.09 | First securities company to connect directly to the “Millennium IT” system of the Mongolian Stock Exchange | First securities company to be connected directly to the Millennium IT system of the Mongolian Stock Exchange, with an online trading system that complies with international standards. |  |

| 2017.09 | Introduced the ability to participate in trade through a smartphone application | Being able to trade securities using mobile phone through E-bank application of the Trade Development Bank is a step towards to introducing advanced time-saving technology to customers. | |

| 2017.12 | Online withdrawal requests were implemented to our online trading system | By constantly developing to our trading system, we introduced the first ever online withdrawal request system in Mongolia that makes the process of withdrawing from the settlement account much easier. | |

| 2018.12 | Transition to T+2 settlement mode for securities payments |  | |

| 2025.11 | TDBS DataLAB | DataLAB is the largest data platform based on the last 5 years of financial and trading historical data of 90+ listed companies actively traded on the Mongolian stock market. |  |

| 2011.12 | Executed 23% of total trade of the Mongolian Stock Exchange | A total of MNT 105.8 billion trade was done in the year 2011 through our company, accounting for 23% of the total trade in the Mongolian stock exchange, the second highest of all securities companies. | |

| 2012.09 | Co-manager for the international note issuance of Trade & Development Bank of Mongolia | We worked as co-manager for the USD 300 Million senior unsecured note issuance of Trade & Development Bank of Mongolia. The bond was priced at 8.5% coupon rate, with a 3 year maturity. 60% were invested by asset management firms, with 25% being banks, and 15% other financial institutions. | |

| 2012.12 | One of the lead managers of the first ever sovereign bond of Mongolia | We worked as a Joint lead manager in the USD 1.5 billion sovereign bond issuance as part of the USD 5 billion Global Medium Term Note program along with some of the largest financial institutions in the world. The bond was a 2 part issue with a USD 1 billion, 5.125% coupon rate, 10 year maturity and a USD 500 million 4.125% coupon rate, 5 year maturity. | |

| 2013.12 | Executed 13% of total trade of the Mongolian Stock Exchange | A total of MNT 26 billion trade was made in the year 2013 through our company, accounting for 13% of the total trade in the Mongolian stock exchange, the third highest of all securities companies. | |

| 2014.01 | Joint lead manager of the first CNH bond of Trade & Development Bank of Mongolia | We worked as joint lead manager for the CNH 700 Million bond issuance of Trade & Development Bank of Mongolia. The bond was the first ever CNH bond issued from Mongolia and had a 10% coupon rate, with a 3 year maturity. 66% were invested by asset management firms, with 8% being banks, and financial institutions, 26% being private banks. |  |

| 2014.12 | Executed 20% of total trade of the Mongolian Stock Exchange | A total of MNT 16.8 billion trade was made in the year 2014 through our company, accounting for 20% of the total trade in the Mongolian stock exchange, the second highest of all securities companies. | |

| 2014.12 | Best Securities Company by the Mongolian Stock Exchange | By providing excellent professional brokerage services in the Mongolian capital markets, and leading in Government securities trading TDB Capital LLC was named the “Best Securities Company” by the Mongolian Stock Exchange in 2014. | |

| 2015.05 | Co-Manager to the international bond issued by Trade & Development Bank of Mongolia | We worked as co-manager for the USD 500 Million bond issuance of Trade & Development Bank of Mongolia. The bond was priced at 9.375% coupon rate, with a 5 year maturity. 90% were invested by asset management firms, with 5% being banks, and 5% other financial institutions. | |

| 2015.06 | Joint lead manager of the first CNH sovereign bond of Mongolia | We worked as a Joint lead manager in the CNH 1 billion sovereign bond issuance of Mongolia along with some of the largest financial institutions in the world. The bond was an issuance with 7.5% coupon rate, 3 year maturity “dim sum” bond and Mongolia became the second country in the world to issue CNH bonds on the international market. | |

| 2015.12 | The Underwriter of the biggest IPO at the Mongolian Stock Exchange | We successfully arranged and underwrote the biggest Initial Public Offering on the Mongolian Stock Exchange of MNT 37.3 billion of “MIK Holding” JSC. With the goal of providing mortgages to Mongolian citizens “MIK Holding” LLC, parent company of “MIK HFC” LLC, successfully became a public JSC contributing to the development of the Mongolian capital market. |  |

| 2015.12 | Executed 21% of total trade of the Mongolian Stock Exchange | A total of MNT 124.9 billion trade was made in the year 2015 through our company, accounting for 21% of the total trade in the Mongolian stock exchange, the second highest of all securities companies. | |

| 2016.04 | Joint lead manager of a sovereign bond of Mongolia | We worked as a Joint lead manager in the USD 500 million sovereign bond issuance as part of the USD 5 billion Global Medium Term Note program along with some of the largest financial institutions in the world. The bond was an issuance with 10.875% coupon rate, 5 year maturity and the third sovereign bond of Mongolia on the international market. | |

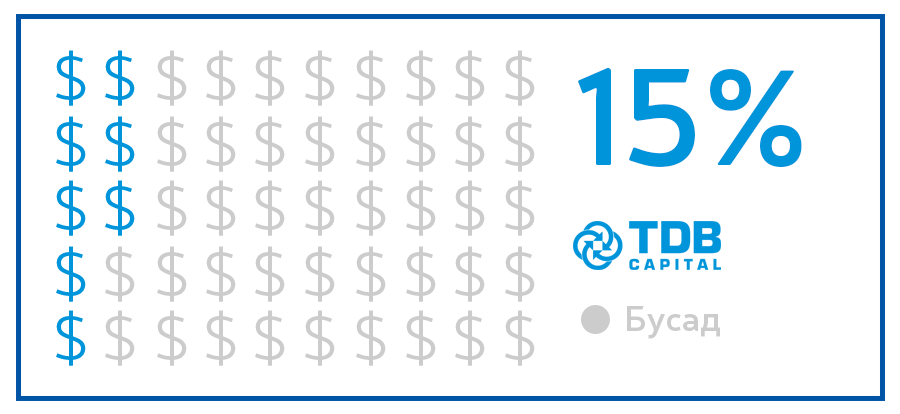

| 2016.12 | Executed 15% of total trade of the Mongolian Stock Exchange | A total of MNT 63.0 billion trade was made in the year 2016 through our company, accounting for 15% of the total trade in the Mongolian stock exchange, the third highest of all securities companies. |  |

| 2017.12 | Executed 49.4% of total stock trade of the Mongolian Stock Exchange | A total of MNT 89.4 billion trade was made in the year 2017 through our company, and executed 49.4% of the total stock trade in the Mongolian stock exchange, the highest of all securities companies in stock trading. |